1st August, 2023

While the improvement of healthcare delivery is a laudable goal that healthcare providers eagerly work to pursue, it is hardly realistic if healthcare stakeholders don’t pay attention to the major role of finance in the healthcare industry.

Without a doubt, hospitals and other healthcare providers deal with a precious task -- caring for human life. However, the sustained performance of this important societal service depends heavily on the prowess of financial departments, which are tasked with financing the growth of sustainable operations, making capital investments (for long-term reduction in operational cost), investing in research and development that will improve healthcare, and identifying expansion opportunities for their services.

In fact, a 2019 study of 108 acute care facilities in New York, published by Plos One Journal, showed a positive correlation between a hospital’s financial condition and the hospital’s quality and safety.

Consequently, healthcare stakeholders that are focusing on taking their operations to the next level must understand how modern healthcare financing services can help them get there.

In this article, we’ll consider how this can become achievable by looking at:

At the end of this article, you will have the solutions you’ll need to overcome common problems facing financial performance in the healthcare industry in order to set up your hospital or clinic for sustained growth.

Before we go further, some words on the meaning of healthcare finance as used here.

By healthcare finance, we mean how healthcare providers make money to finance their operations and achieve their goals. The concern of healthcare finance includes revenue generation, accounts receivables, revenue cycle management, payment default, cash flow, and working capital, among others.

Because the popular belief is that human life is worth more than anything else, some medical professionals and stakeholders have a tendency to avoid discussions about finance and revenue when it comes to the healthcare industry. However, while this sentiment may be important to recognize and acknowledge, it is not practical.

Hospitals need to maintain strong financial health just like every other company and their ability to even exist (not to mention growing and improving healthcare delivery) depends firmly on the financing system they manage and deploy.

To understand why healthcare finance is a crucial part of this business, consider the following roles of finance in the healthcare industry:

Before hospitals and other healthcare systems can attend to the needs of patients, they need to put many things in place -- a building, medical and non-medical staff, medical equipment, utilities, IT systems, among others.

An obvious line item on the hospital’s profit/loss statement is wages and salaries. Hospitals employ a variety of healthcare professionals including doctors, nurses, patient advocates, physician assistants, lab technicians, and physical therapists, among others. Other non-health professional staff include accountants, human resources personnels, tech experts, cleaners, and security personnels, among others.

Operational costs also include the maintenance of IT infrastructure and medical equipment. If the hospital doesn’t own its building, rent is another major operational cost. On top of this, we’ll add the cost of lighting, internet subscriptions, phone calls, and other utilities and then it becomes evident that operating a hospital costs a lot of money. And all the above is not even a comprehensive list.

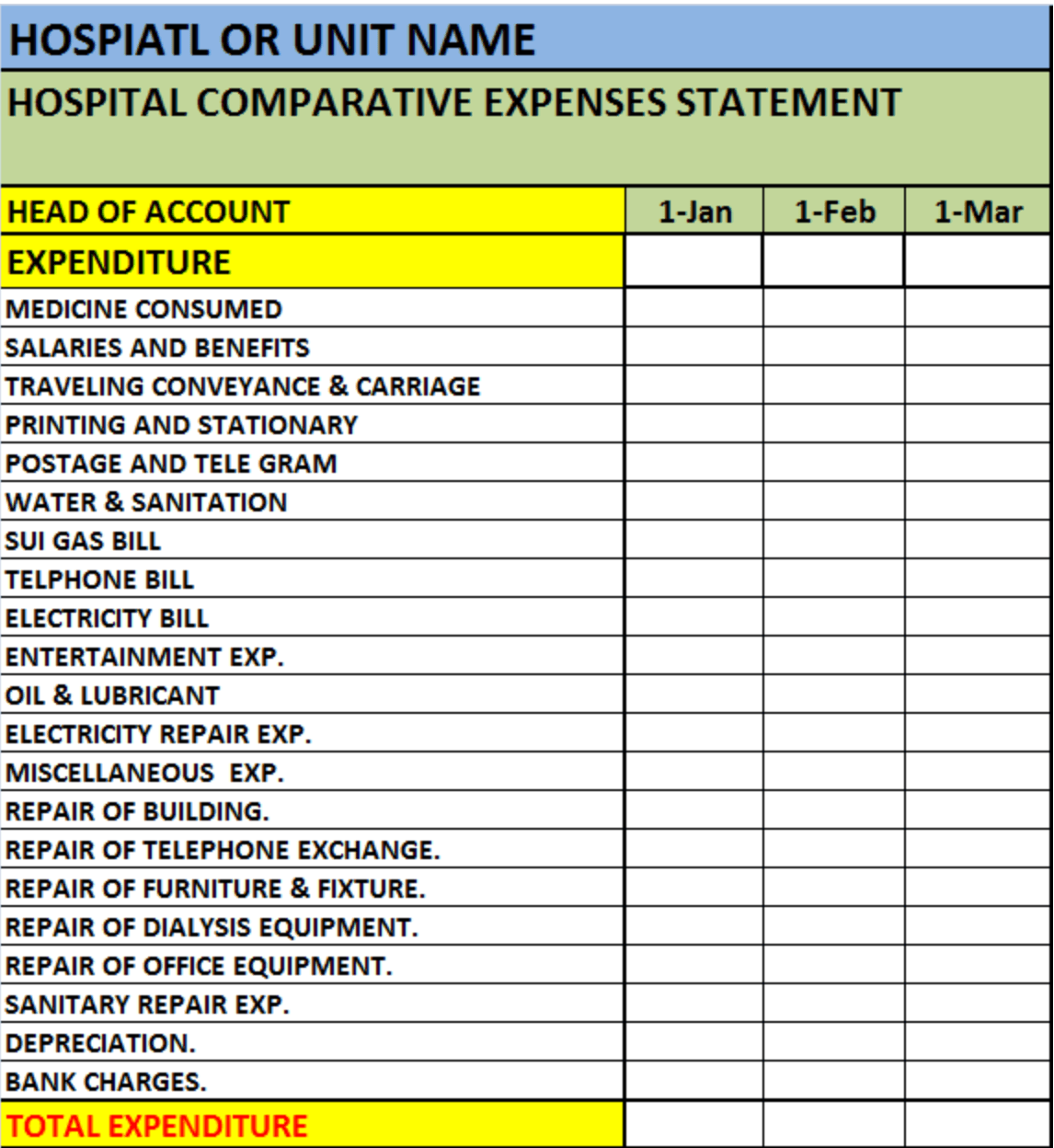

Below is an hospital expense sheet template that shows a number of operational expenses hospitals usually are required to make:

Source: Free Report Templates

In an effort to put a more concrete amount on operational costs, Manoj Nair, associate editor at Gulf News, in an interview with a healthcare operator found that a mid-sized clinic in the UAE requires a monthly working capital of AED 1 million to meet its obligations.

Meeting all of these monthly expenses requires a well-oiled financial revenue cycle management cycle, as we’ll see.

Furthermore, to improve operations and reduce the cost of operations in the long term, hospitals need to reinvest capital, especially in new physical and digital infrastructure.

For example, when Covid-19 hit and hospitals had to deploy remote healthcare capabilities, they invested in various technologies that would make that possible.

But even beyond emergency deployments of technology, hospitals that want to remain competitive and keep delivering better value to patients must invest in better technologies, medical equipment and facilities.

For example, the continuous training and education of their healthcare staff is also a capital investment -- that is, human capital -- which is essential to the long-term quality of healthcare delivery.

Healthcare providers also provide a major role in R&D development of their industry, and this role usually includes providing both financial and knowledge-based resources.

According to the US Medical Health Association (MHA), healthcare research and development (R&D) are funded by “industry; the federal government; academic and research institutions; foundations, voluntary health associations, and professional societies; and state and local governments.”

While the funding of R&D is not their sole responsibility, healthcare providers (referred to as "industry" above) are expected to play a part in funding scientific and medical research.

Hospitals also need to expand by incorporating more medical services or by opening another hospital or clinic in an underserved location.

For the former, increasing the range of services available to patients is a big part of healthcare delivery and quality. However, to incorporate previously unavailable services costs money. Setting up facilities for heart surgery, for example, is a capital-intensive project.

For the latter, taking healthcare services to new communities has long been a crucial part of business expansion in the industry. However, building hospitals in new locations also costs money. And all that money has to come from somewhere.

So, where does healthcare financing come from and is it best allocated to achieve sustainable growth?

Having understood the role of finance in healthcare, let’s consider the primary sources of finance for hospitals.

Before health insurance became popular, patients paid money out of their pockets for the medical services they received. In many cases, such payments were made before service delivery.

However, with health insurance, patients only pay money out of their pockets when there is a copayment arrangement with the insurance provider. Basically, a copayment is a portion of the total cost of a health service that is paid by the patient instead of the insurer.

These copayments constitute a portion of the total revenue that healthcare providers receive.

The other portion of hospitals’ revenue comes from insurance medical claims processed and paid by insurance companies.

When a patient receives a healthcare service, the part that is not covered by copayment is paid by the insurance company. The hospital must prepare an insurance claim detailing the service that was rendered and the cost and submit it to the insurance company for processing and payment.

Below is an illustration of how this process works:

Source: PrognoCIS

With mandatory insurance policies in the UAE, Oman, and Saudi Arabia, healthcare providers have to now depend on insurance companies for a bulk of their revenue.

While health insurance has made healthcare more accessible for many patients, its rise, especially in countries where it is mandated, has led to new financial challenges for healthcare providers.

This is particularly a complex issue when managing healthcare medical claims.

The first problem is that insurance companies sometimes reject the medical claims prepared by hospitals.

In the Middle East, the rejection rate can be as high as 30%, according to Azad Moopen, managing director of Aster DM Healthcare, a private healthcare conglomerate in the Middle East. Even when such rejected claims are reprocessed, there is still a 15% rejection rate.

Research by Change Healthcare Index shows that 24% of rejected medical claims cannot be recovered. Every unrecoverable medical claim is a loss to the hospital.

Moreover, even when the claim is recovered, resubmitting medical claims is an additional expense which is another reduction in the net revenue of hospitals. Aside from the extra cost of resubmitting claims, claim denials increase the time it takes for hospitals to receive cash for services already rendered.

Karen Wilson at Odyssey Recruitment, a medical professional recruitment agency, says it takes between 90 days (3 months) and 180 days (6 months) before hospitals can receive cash from a submitted medical claim.

When you add the impact of high medical claims rejection rates, Manoj Nair says it sometimes takes between 180 days (6 months) and 730 days (2 years) before hospitals can resolve claims to receive cash.

The period between when insurance claims are prepared and when cash is received is called the accounts receivable days (AR days).

Consider that Medusind, a revenue management company in the US, says that AR days between 35 and 50 days is average and more than 50 is poor.

If AR days numbering more than 50 are considered “poor”, AR days that are more than 180 and up to 730 are clearly a major industry challenge to overcome.

The current challenges of finance in the healthcare industry goes beyond the insurers.

Patients can also be reluctant to pay. And when they pay, the payment can be delayed. Research by Jonathan Wiik, Principal And Lead Of Revenue Cycle Management Solutions for TransUnion Healthcare, shows that 74% of healthcare providers in the US say it takes more than one month before patients pay their portion of the cost of the health service, with 66% seeing this delay as a source of concern.

The combined effect of these three financial challenges is that most healthcare providers, especially smaller hospitals and clinics, run into concerning cash flow problems.

Many hospitals don't have enough cash for basic operational management. As Nair puts it, "There has been much market talk about layoffs, extended “vacations” for personnel, and even cuts in the salaries and benefits to even doctors."

Also, hospitals have to constantly postpone their capital investments, R&D, and expansion plans due to uncertainty about when they will receive cash. Let's even ignore the fact that the delay can lead to lost opportunities.

Similarly, inflationary pressure means that the money the healthcare provider is receiving months later is less valuable (in real terms), which means they will have to spend more for the same investments.

Given all these, the role of finance in healthcare should be more evident.

Is there a way out of this impasse for healthcare providers?

There are two important solutions and one fundamental solution. The former will scratch the surface but the latter will totally transform the experience of healthcare providers.

Let's start with the important solutions.

First, healthcare providers must reduce medical claims rejection to the bare minimum. One way to do this is to employ better Revenue Cycle Management (RCM). A better RCM will be data-driven, helping hospitals identify the top reasons for denials, and AI-empowered, helping them predict the probability that a claim will be denied before sending it.

Also, by helping to better understand top reasons for claim denials, your finance and medical staff will jointly be able to specifically avoid those problems in future claims.

However, while a reduction in medical claim denials will reduce revenue loss, it will not solve the problem of long AR days which makes hospitals wait for months to access the money they need to meet their operational expenses and undertake proposed investments.

On the side of patients, to reduce the rate of default in copayments, hospitals need to be more transparent about what the patients are paying for. To this end, there is a need for pre-appointment checks where providers set expectations with patients, explaining the problem, the treatment options, the cost of the service, and what portion they can expect to pay as copayments. Such transparency can drastically reduce default.

Similarly, hospitals need to understand their patients and give them what they want. Today's patients want multiple payment options (cash, POS, bank transfers, etc) and digital communications (email, social media, etc) so they can communicate and pay on their own terms.

Nevertheless, a reduction in default will not solve the problem of delay in payment. Copayments taking more than a month remain a strain on cash flow.

What if it can be better?

For healthcare providers to improve financial performance, the most fundamental solution is to provide a way to gain shorter AR days.

Simply put, hospitals need to access their cash soon enough so they can meet their operational expenses and undertake other investments in order to provide continuously more competitive services.

Klaim is spearheading this transformation by providing a platform where hospitals can turn their medical claims into cash within seven days. Through advanced healthcare financing services, Klaim purchases medical claims with a good chance of being accepted (rather than denied) for a certain financing fee, calculated as a percentage of the total value of the claim.

With this system, healthcare providers can access funds within seven days and avoid the days of "layoffs, extended vacations” for personnel. These financing solutions chiefly aim to enable the owners, CEOS and top management of hospitals and clinics to run seamless operations, hire top professionals, buy new equipment, and expand the medical practice.

To solve these challenges, they need a better RCM, more transparency and flexibility, and a financing solution that allows them to access their cash faster.